Greenhouse gas (GHG) emission reporting is rapidly approaching for many Australian businesses. A staged approach is being undertaken to mandatory reporting, starting with larger businesses, however the data that needs to be gathered across supply chains will impact many smaller businesses too.

This article aims to explain the nuts and bolts of reporting on GHG emissions, also referred to as Carbon accounting.

What needs to be reported?

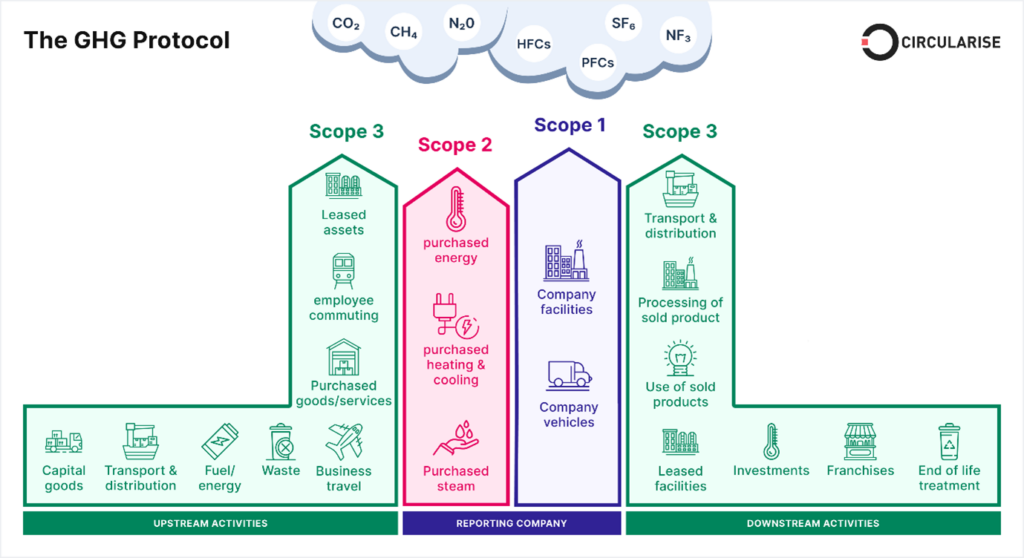

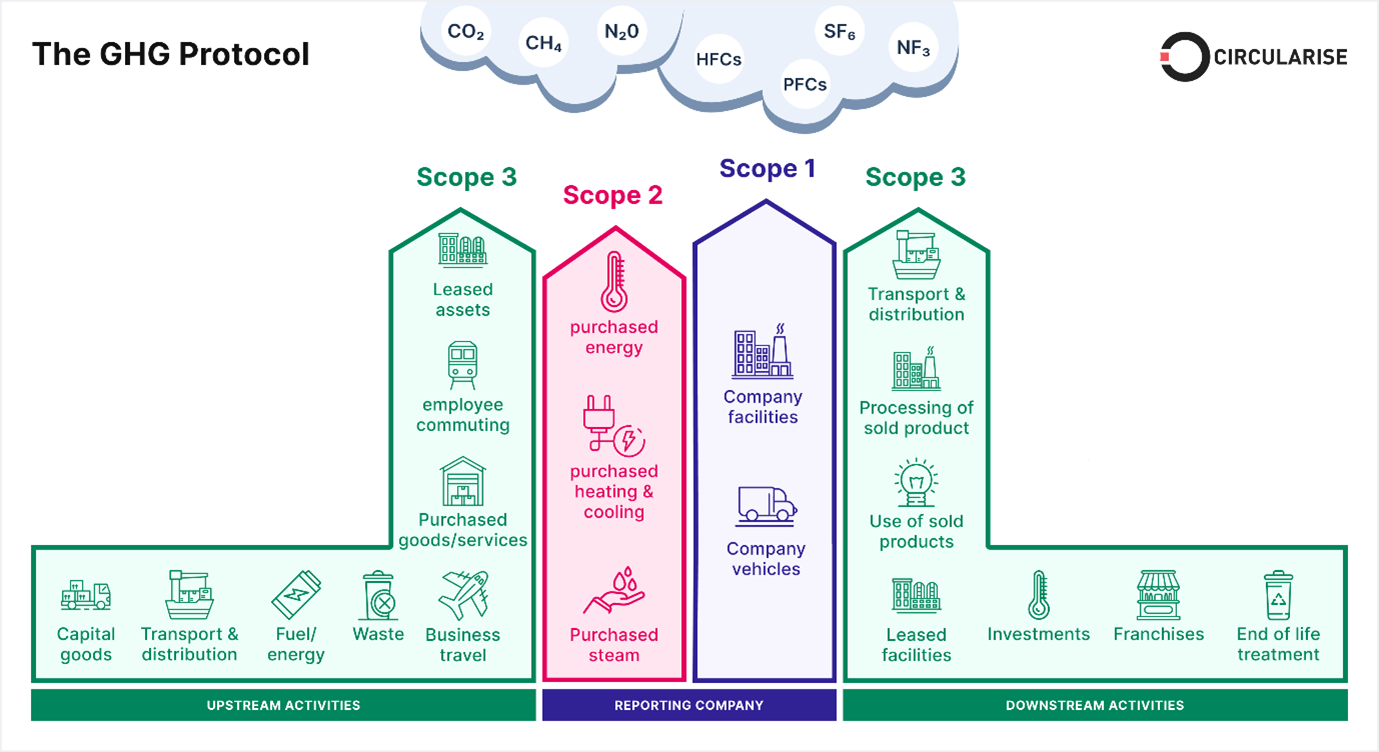

The Greenhouse Gas Protocol has determined the framework and standards for the accounting and reporting of GHGs. There are several gases that need to be considered, but without getting too bogged down in the science, the framework also determines how each of these gases can be converted and measured as a carbon dioxide equivalent. Carbon accounting simply accounts for each of these according to the activities of a business. (For the science-minded, the GHGs include carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFC), perfluorocarbons (PFC), sulphur hexafluoride (SP6) and nitrogen trifluoride (NF3)).

GHG emissions are classified according to where they originated. They are considered Scope 1, Scope 2 or Scope 3 emissions. Currently, many companies, as part of their ESG (environmental, social and governance) strategy, report on Scope 1 and 2 emissions, and mostly this is voluntary. With the upcoming mandatory reporting, however, this will be expanded to include Scope 3 emissions.

Importantly for our small business clients, Scope 3 emissions include those produced along the supply chain. This will likely include a very large number of YBM business clients!

Staged reporting

Mandatory disclosure of all GHG emissions will be staged, according to business size:

- From 2024-25, businesses with over 500 employees, carrying more than $1 billion in assets and a consolidated revenue of more than $500 million.

- From 2026-27, businesses with between 250 and 500 employees, $500 million in assets and $200 million in consolidated revenue.

- From 2027-28, medium sized businesses with over 100 employees, $25 million in assets and consolidated revenue over $50 million.

Take home message

While it may be some time before small and medium sized businesses need to publicly disclose their GHG emissions, it will not be long until they are asked for that information in order for large businesses to report.

YBM have put together a series of blogs to help our clients understand the reasons behind upcoming disclosure requirements, and solutions to ensure that clients can provide the data required. For more information, please visit our blog page, or contact our office and speak to one of our team about Carbon Accounting.