Blogs & Vlogs

Carbon Accounting – YBM’s Chosen Solution

Discover YBM’s exciting adoption of Sumday, a cutting-edge Carbon Accounting platform, for proactive GHG reporting compliance.

Carbon Accounting – Who And How?

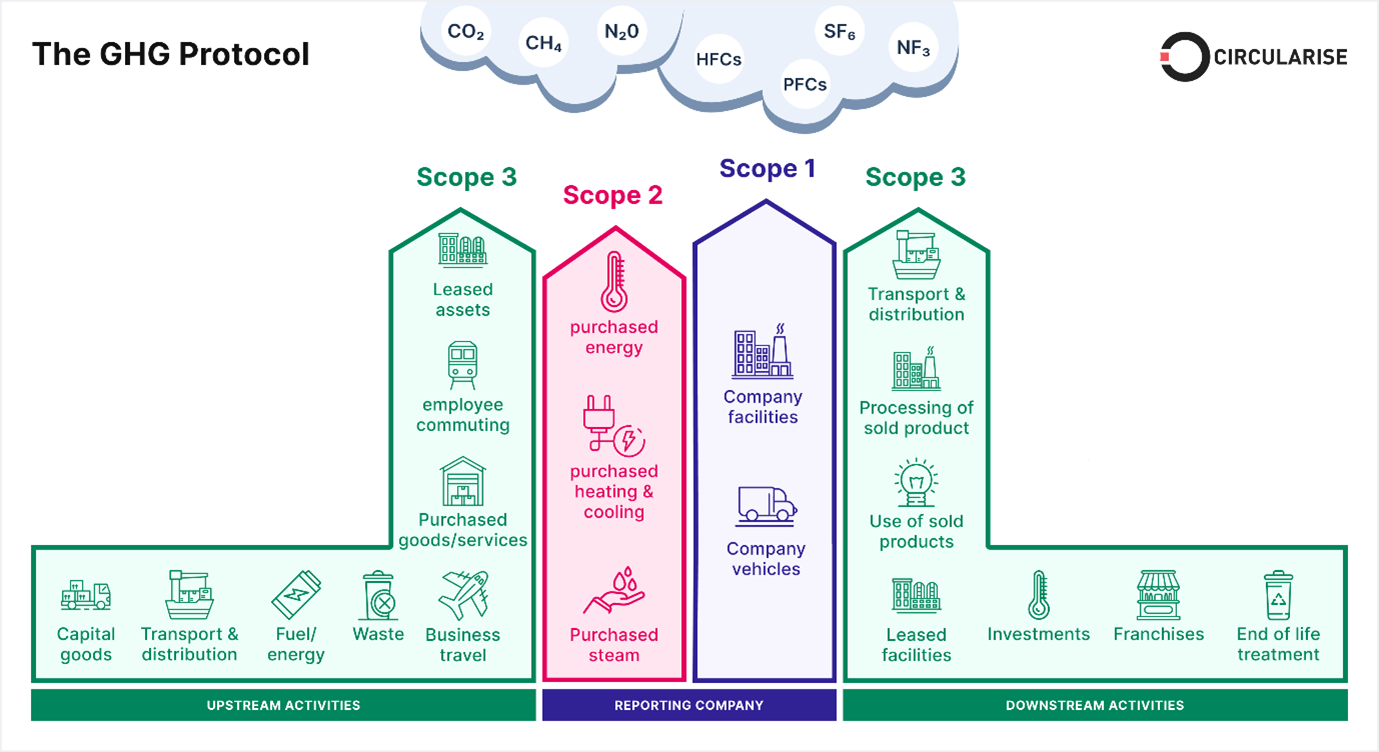

Explains the nuts and bolts of reporting on GHG emissions, also referred to as Carbon accounting.

Are You Ready To Report On Your Carbon Footprint?

To keep clients ahead of the game, YBM are working on a number of strategies in order to provide assistance in this rapidly-evolving space.

How much should I draw from my pension?

Many retirees use their superannuation to commence a pension that pays income

Understanding Sales Tax for Small Businesses

The Australian Taxation Office (ATO) applies sales tax to businesses turning over

Small Business Tax Tips for Independent Contractors

Over 1 million independent contractors in Australia thrive on the benefits of

Small Business Tax Penalties: What You Need to Know

Businesses and individuals are legally obliged to pay taxes to contribute to

Understanding Sales Tax for Small Businesses

When you’re running a business, sales tax, more commonly referred to as

How to Use Accounting Software to Manage Your Small Business Finances

Small business owners need to consider many things, and effectively managing your

RECENT POSTS

12 Easy Things Small Business Owners Can Do to Start the New Year Off Right